这周内容有点多。

War

预测战争是一件很难的事情。

Russia’s Only Sabre-Rattling. Putin Won’t Invade

That was the dominant narrative right up to the moment that Russia invaded.

Russia Takes the Country in Days; There’s Nothing Anyone Can Do About It

This one lasted for about four days after the invasion, and began to go into eclipse as stories that Russia was bogged down became more frequent in the conflict’s second week.

Plucky Ukraine Has Delivered a Historic Defeat on Putin’s Russia. Good for Them!

This narrative, understandably popular in the west, took hold after Russia abandoned its attempt on Kyiv.

Putin Has Turned This Into a War of Attrition. It’s What Russia Always Does, and It Works

Russia’s capture of Mariupol, and the steady drip of news that it was reinforcing its hold over the most strategically important parts of Ukraine, turned this into the dominant narrative about two months ago.

Ukraine Is in the Ascendant! They Have the Russian on the Run!

印度的态度

Indian prime minister Narendra Modi has told Russian president Vladimir Putin that now is “not an era of war”, in some of his most pointed public remarks yet about Russia’s invasion of Ukraine.

中国的态度

“We highly value the balanced position of our Chinese friends when it comes to the Ukraine crisis,” Putin told Xi, according to a Kremlin transcript. “We understand your questions and concerns about this. During today’s meeting, we will of course explain our position, though we have also spoken about this before.”

德国一开始是送头盔,现在被要求送坦克

Scholz has maintained a cautious stance on arms deliveries to Ukraine, sending sophisticated artillery pieces and armoured vehicles as well as multiple rocket launchers but stopping short of providing battle tanks.

俄罗斯如果需要和北朝鲜进口武器,情况自然不妙

“By the end of this year, the Kremlin will lose almost all of its artillery ammunition, almost all of its armoured vehicles, battle tanks and the main part of its ground forces,” says Pavel Luzin, an expert on the Russian military. “How can you continue the war without artillery and troops?”

但同时失败又是不被接受的

Some military analysts believe he has little choice but to order a significant escalation of the conflict.

不要预测,做好应对就可以了。

Energy

欧洲宣布过冬的问题解决了

Europe has successfully headed off an energy crisis for now by taking strong measure to control prices and keep storage tanks of natural gas full heading into winter, France’s ambassador to the US said in an interview.

“We have taken very, very strong measures,” Ambassador Philippe Etienne told Bloomberg Television. “Now the storages of gas are well filled in Europe, in France, but also in other countries, so the affordability question is has been a thing successfully handled.”

天然气的价格又开始下跌。

有人质疑这次能源制裁的方式很有问题

During the first Gulf War, we went to all of our oil-producing allies and the coalition and said “Pump” because we were trying to rob Saddam Hussein of his oil revenue. The price of oil can be pushed down, but only with supply. So attacking his volume, which we have been loudly saying is a mistake from the beginning, has indeed proven to be a mistake.

既然管不了supply,那就搞demand destruction

至于明年会怎么样,那就明年再考虑吧。

European natural gas traders know the sector faces a tough winter ahead, but some have started to make a bold prediction: maybe, just maybe, prices have peaked for the year.

Goldman Sachs this week said it forecast European prices would fall through the winter, potentially to below €100/MWh by the spring, before rebounding next summer as traders rush to refill storage facilities.

20年前,天然气在欧洲并不是一个问题

如果进入stagflation,能源是被看好的资产。现在一些有利的因素是,shale产量放慢,政府战略贮备用了不少,美元可能的见顶。但是短期也有recession的风险。看一下1970年,能源股的价格也还是和大盘方向一致的,就是幅度不同罢了。这不是一个无脑持有的资产。

CVX的股价

大盘的走势

这张油价的图,让我再想这是不是以后的锂矿价格图

最后,一个共识是俄罗斯的能源行业基本完蛋了,历史绕了一个圈

It’s easy to forget now, but the biggest beneficiaries of the oil embargoes of the 1970s weren’t Riyadh or Tehran. Oil production from Middle Eastern countries fell by about 4.6 million daily barrels between 1972 and 1982. Ironically, Moscow was the biggest winner: Soviet production rose by 4.3 million barrels.

By cutting off almost all gas supply to Europe, Putin all but guarantees a similar outcome to the Gulf five decades ago — losing market share to alternative suppliers and new energy sources.

How does the invasion affect that? The first consequence is the self-destruction of Russia’s gas market in Europe. The second is the likely decline in Russia’s oil exports to Europe, as the embargo kicks in, forcing Russia to accept discounts and higher costs to move its oil to other markets. Both of these will affect Russia’s revenues in this decade.

最后就买给中国和印度,可以参考上面这两个国家对战争的看法。

Inflation

预测通胀也是一件很难的事情。

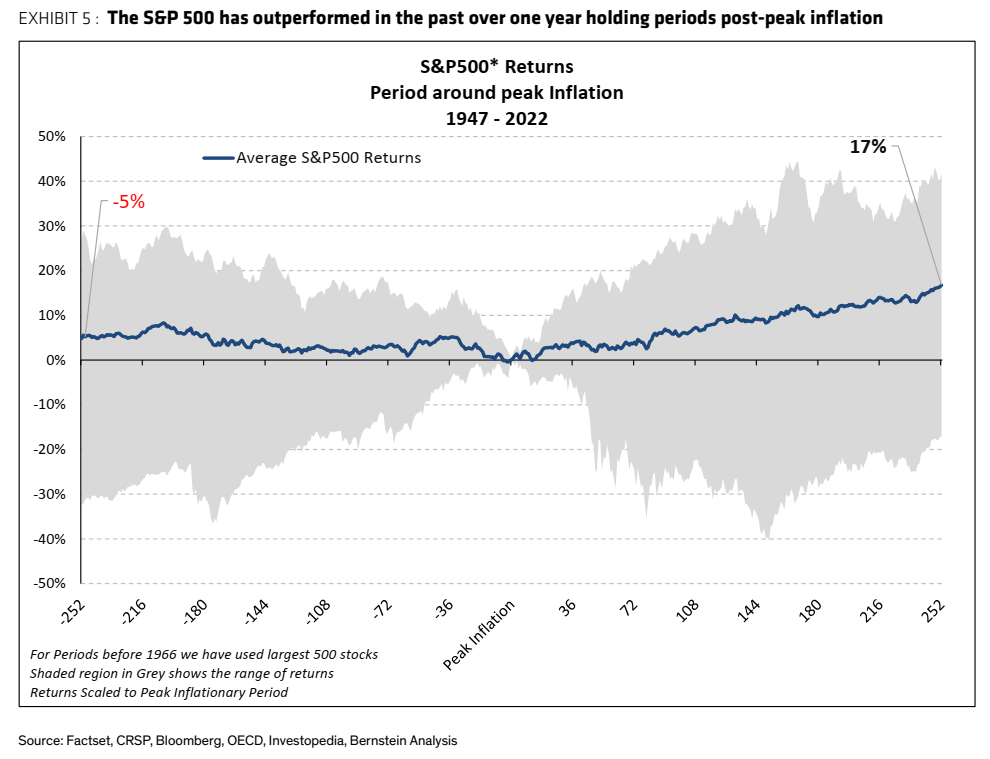

这图看上去很bullish

有人说peak inflation的12个月后,平均收益有17%。好像也有人淹死在平均深度只有1米的河里。

之前有谈到一个观点,通胀是一个complex的问题。不是解决了A,就解决了通胀这么简单的。油价问题解决了,工资的spiral开始了。

FED的行动不是太早,就是太晚。行动的力度不是太少,就是太多。其实要求他完美执行根本就是不现实的。所以exploit FED的错误是一个很好的思路。

如果crypto可以取代tradfi,那FED不如考虑用AI。比如号称可以预测complex system的reservoir computing。

Ott and his collaborators used a less computationally expensive training method called reservoir computing, which adjusts only a few connections in a single layer of artificial neurons. Despite its simplicity, reservoir computing seems suited to the task of predicting chaotic evolution.

In a new paper, posted online in July and now undergoing peer review, Ott and his graduate student Dhruvit Patel explored the predictive power of neural networks that only see a system’s behavior and know nothing about the underlying parameter responsible for driving a tipping-point transition. They fed their neural network data recorded in a simulated system while the hidden parameter was drifting, unbeknownst to the network. Remarkably, in many cases the algorithm could both predict the onset of tipping and provide a probability distribution of possible post-tipping-point behaviors.

Surprisingly, the network performed best when trained on noisy data. Noise is ubiquitous in real-world systems, but it ordinarily hinders prediction. Here it helped, apparently by exposing the algorithm to a wider range of the system’s possible behavior. To take advantage of this counterintuitive result, Patel and Ott tweaked their reservoir computing procedure to enable the neural network to recognize noise as well as the system’s average behavior.

看看已经在经历高通胀的国家,比如土耳其,一个放弃抵抗通胀的国家。

通胀的开始是利好经济

While conventional wisdom suggests that inflation leads to a drop in demand, Doğancıoğlu said that past crises in Turkey had often shown the opposite to occur — at least initially. The same was true in this case.

出口的企业过的好一些

Many of the most successful Turkish businesses — including those in the automotive, chemicals and textiles sectors — have prioritised exports, taking advantage of the weaker lira to sell their goods across the world and helping to power economic growth.

It has been tougher for those heavily reliant on local sales. Fitch last month downgraded the debt rating of a string of corporates, including white goods maker Arçelik and the telecoms company Turkcell, because of their high exposure to the domestic market.

工资的压力。

As price rises began to take off in the summer of last year, Mustafa Tonguç, the chief executive of DHL Express in Turkey, complied a list of the cost of 50 basic products and compared them with their equivalents in Germany in an effort to persuade bosses in the logistics provider’s headquarters to raise the wages of his 1,100 staff. He would raise them a further three times in the year ahead.

整体的倒退

Others praise the resilience but lament the missed opportunities for the country, where GDP per capita is down from a peak of $12,600 in 2013 to $9,600 last year — a stark illustration of the erosion of prosperity.

下周75bps或100bps重要吗?

FED肯定会pivot,问题是when?

或者QT breaks something

Recession

观察Recession不是很难。

卡车运费

物流板块突破之前的低位

Fedex的财报

FedEx released preliminary results for the three months to August 31 that were weaker than analysts expected, blaming “global volume softness” that “accelerated” in the final weeks of the quarter.

Nucor的财报

Nucor (NUE) said Wednesday that it now expects third-quarter earnings that are well below analyst estimates, attributing the shortfall to "metal margin contraction and reduced shipping volumes particularly at our sheet and plate mills."

Alcoar的预警

Alcoa Corp. is getting squeezed by higher energy costs and lower aluminum prices, which the company warned investors late Wednesday will result in lower earnings for the third quarter.

消费者信心

SaaS的guidance很保守

End of Super Cycle是不是正式开始了?

Companies

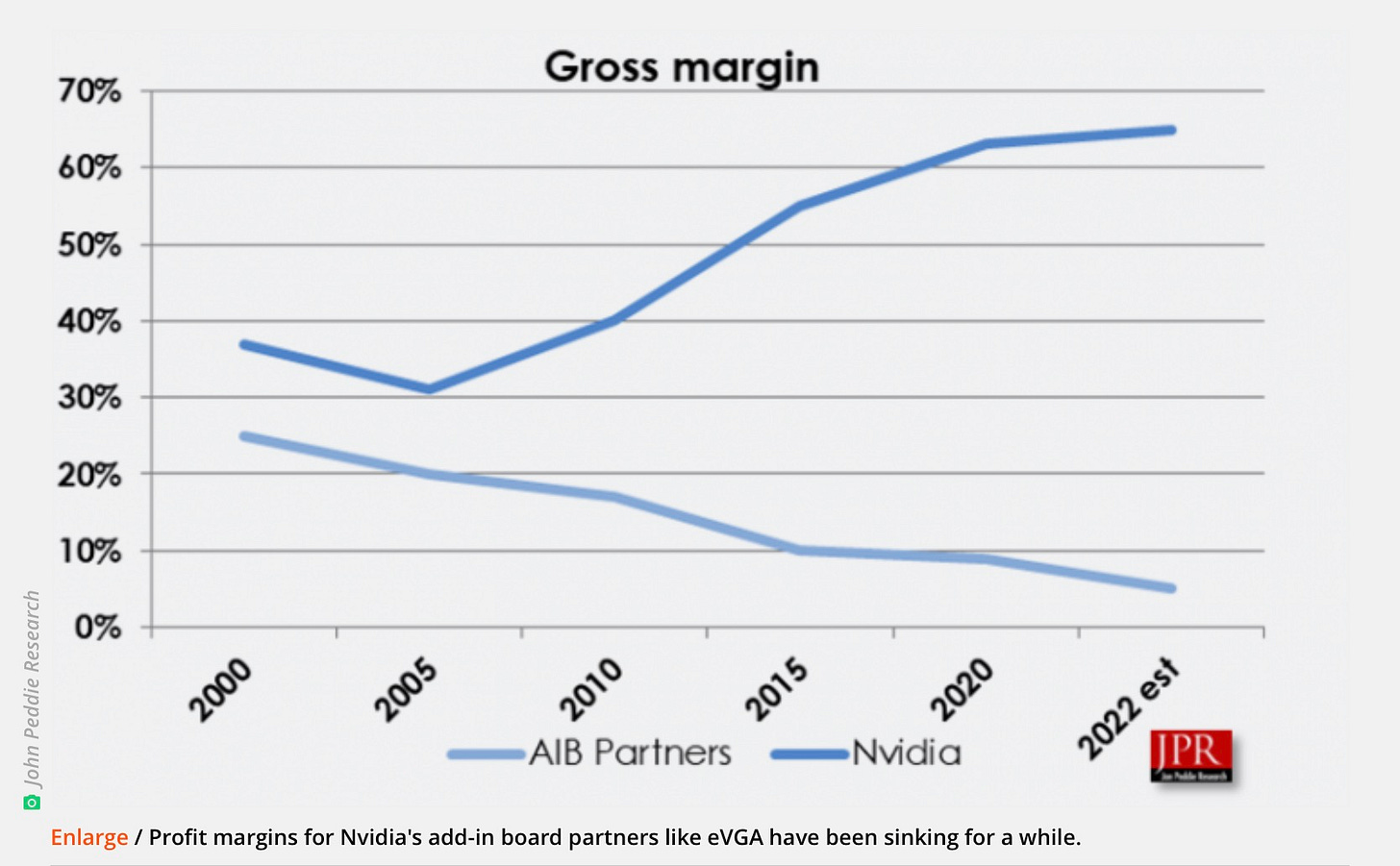

Nvidia和长期的合作伙伴分手。据说是合作伙伴赚不到钱。

Cruise也决定不和Nvidia玩了,因为量少,vendor没有给折扣,感觉没有被尊重

"Two years ago, we were paying a lot of money for a GPU from a famous vendor," Carl Jenkins, head of Cruise hardware, told Reuters in an apparent reference to Nvidia, a leading maker of graphics processing units, or GPUs.

Intel的新GPU产品还不错

Even with these issues, I would say XeSS is shaping up to be a great success. Like the best upscaling solutions, it can beat the look of native 4K in some scenarios - even in performance mode, which uses a 1080p base image. It is directly competitive with DLSS in scenarios that I consider to be 'hard mode' for image reconstruction techniques.

但是Nvidia对比Startup还是很有优势

While other AI accelerators such as Graphcore IPU and Habana Gaudi offer direct links to other chips for inter-node communications to scale to hundreds or thousands of accelerators, most do not. Furthermore, most of these competitors don’t seem to have immediate plans for co-packaged optics or purpose-built switch architecture with in-flight compute capabilities. Even if these competitors’ compute architecture is multiple times more efficient while retaining flexibility and programmability, these firms also need in-house networking expertise.

和incumbent对着干是很难的,要迂回。比如RISV-V

SiFive can offer something Arm cannot, flexibility. Customers can modify their cores by adding hardware accelerators directly into the vector register file. This can be used for extending the X280 core to applications such as DSP, image signal processing, and AI.

Amazon最近对Shopify接连出招,Buy with Prime,Amazon Warehousing & Distribution,到这周的Shipping Services。

Amazon has announced that it’s launching a new version of Veeqo in the United States. Veeqo is a multichannel shipping service that allows sellers to grow their business, fulfil orders faster, and even cuts shipping costs by checking automatically with different shipment companies for the lowest rates based on the size and weight of the item being sold.

Veeqo has been around for almost a decade now, but Amazon acquired it earlier this year. Veeqo used to cost $450 per month, but it’s now free under Amazon’s leadership, with sellers only required to purchase carrier labels.

Wise用了15个工程师和1年的时间,把card processing从Galileo转为In-house。Card Network提供了很多帮助。Marqeta的风险指数又增加了。

Previously, every integration with Visa or Mastercard required a physical Hardware Security Module (HSM) machine which slows things down when expanding — and has associated costs. On the other hand, Wise, together with Visa engineers, built the world’s first processing without a single piece of hardware. And it can serve almost every region on top of AWS (Amazon Web Services cloud).

Ideas

TRQ结束了,BHP还是准备加价收购OZ Mineral。

BHP Group Ltd. is considering raising its A$8.4 billion ($5.6 billion) offer for OZ Minerals Ltd., people familiar with the matter said, as the world’s top miner seeks to boost its exposure to metals needed for the green-energy transition.

看了下铜的价格,是不是可以赌一把?

现在的高息对于有收存款的银行很有利

在英国,NatWest已经验证了这一情况。而且就算考虑recession default rate的升高,利息还是多赚很多。

Initially, excess liquidity found an outlet in mortgage markets, which attracted more competition. However, now that policy rates are rising, deposits are becoming much more valuable. Banks have such an abundance of deposits that there’s no compunction on them to pass rate rises through to customers. Even corporate deposits, which have traditionally been more flighty than retail deposits, don’t have to be remunerated as keenly in this rate tightening cycle. And few banks are as exposed as NatWest. The bank has passed on only around 20% of the hike in rates to retail depositors and around 10% to corporate depositors.

JPM也有类似的言论

Pinto also said interest rate rises by the Federal Reserve, increasing loan demand and higher revolving balances at its cards business would boost lending business more than the bank had previously anticipated. JPMorgan’s latest guidance for full-year net interest income, excluding its trading business, was $58bn-plus. Pinto said the current environment meant that plus was now “bigger”.

有意思的是,Buffett新投了Ally Financial而不是加注BAC。

Trading Updates

周一,DAX涨的太快,放弃了。延续上周的思路,卖掉DRIP,买入Uber。

周二,CPI数据吓人。盘前清空了所有交易的仓位。盘中建立空仓,NVDA,SOXS和SQQQ。

周三,再赌一把中国,2823和9988。建仓CRSP,CRBU。看到天然气反弹很多,睡前放了一张KOLD的买单,醒来居然成交了。

周四,ADBE收购Figma盘前大跌,赌一把试试,没有成功。卖出部分Marqeta。加仓SOXS和SQQQ。

周五,盘前加仓KOLD。接着NTLA大跌,加仓CRBU,建仓EXAI。

备注,持有的股票包括MQ,PL,PTON,OMGA,IOBT,AUTL,RLAY,ABCL,CRSP,CRBU,EXAI,GRPH,ONCT,KOLD,NVDA(Short),SOXS,SQQQ,2823,9988.